STS Holding: NGR for Q1 2022 is the highest in the history of the STS Group

Adjusted EBITDA increased by 17% year-on-year, EBITDA margin reached 45.3%

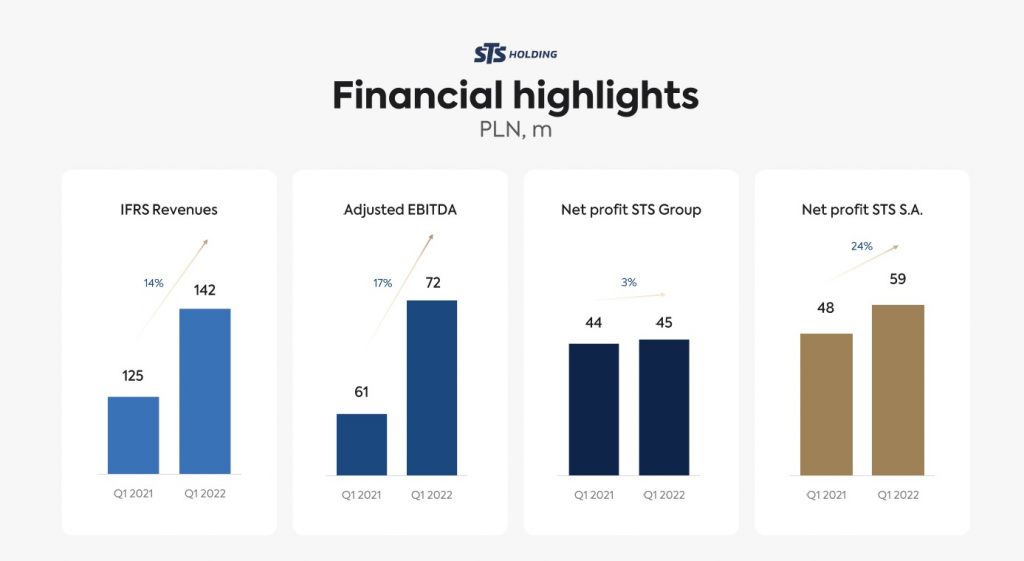

Between January and March of this year, the STS Group – one of the largest bookmakers in Central Europe and the market leader in Poland – generated a record-breaking quarterly NGR of PLN 158 million. This corresponds to a year-on-year increase of 15%. Adjusted EBITDA for the first quarter of this year was PLN 72 million, compared to last year’s result of PLN 61 million, which means a year-on-year increase of 17%. In Q1 2022, the STS Group generated a revenue of PLN 142 million, which means a year-on-year increase of 14% relative to PLN 125 million generated in Q1 2021. Last year, net profit of the Group for the first quarter increased by 2% and reached PLN 45 million. In Q1 2022, STS S.A. – the main operating company of the STS Group – generated a net profit of PLN 59 million, which means a year-on-year increase of 24%.

“Throughout the first three months of 2022, despite the war and inflation, we were able to achieve excellent operational and financial performance. During that period, adjusted EBITDA increased by 17% year-on-year, while net profit of STS S.A., our main operating company, by an impressive 24% year-on-year. As declared, we will be sharing the generated profit with shareholders of STS Holding. It is worth noting that this year, increased acquisition and activity of players will occur during the second half of the year due to how sports events are scheduled, including the World Cup in Qatar, where our national team will also be playing,” says Mateusz Juroszek, President of the Management Board of STS Holding.

At the end of 2021, the Group had no external debts or liabilities towards banks, and the lines of credit extended to the Group were unused. In total, the STS Group has over PLN 305 million in reserve capitals, including PLN 185 million in cash and cash equivalents and PLN 120 million in unused lines of credit.

Between January and March of this year, the STS Group generated a record-breaking quarterly NGR of over PLN 158 million, compared to nearly PLN 138 million in Q1 2021, PLN 136 million in Q4 2021, and close to PLN 158 million in Q2 2021, which was the previous best quarter in the history of the Group. NGR means the value of bets placed by customers less paid out winnings and gambling tax.

During the first three months of 2022, the value of bets placed by STS Group customers was nearly PLN 1.1 billion. The number of active users reached 350 thousand. The Group recorded 64 thousand new registrations, while 41 thousand customers made their first deposit.

In 2021, the STS Group generated a record-breaking adjusted EBITDA of PLN 216 million, compared to PLN 151 million in 2020. This means a year-on-year increase of 43%. In 2021, revenue of the STS Group was PLN 498 million, compared to PLN 389 million in 2020, meaning a year-on-year increase of 28%. Net profit of the Group increased last year by 29%, reaching PLN 131 million. In 2021, STS S.A. – the main operating company of the STS Group – achieved a historic net profit of PLN 153 million, meaning a year-on-year increase of 21%. The STS Group recorded its best financial performance in history.

The STS Group is the largest, in terms of turnover, bookmaker in Poland. The Group also conducts operations on an international scale through licences held in Great Britain and Estonia, from where it offers its services in several markets. Products offered by the Group include sports betting, betting on virtual sports, online casino (outside Poland), BetGames products and a wide range of products which involve betting on results of esports events.

For many years, the Group has continued to implement a “mobile-first” strategy based on a bookmaking system developed by the Group itself. It has been constantly developing its own technological platform to meet customer needs and set market trends. In 2021, investments made by the Group in product portfolio and technological solutions amounted to PLN 29 million. In addition, in 2020, STS S.A. took control of a Czech technological company Betsys and currently owns 74% of its shares. Betsys is the main provider of IT solutions for the bookmaker in Poland, both for online channels and for retail channels. In total, the Group’s Product and Platform Development Team has approx. 160 highly-qualified members, including approx. 85 programmers, 55 other employees responsible for development of technologies and platforms and 20 employees responsible for business intelligence and business analytics.

***

More information:

STS Press Office

E-mail: [email protected]

***

About the STS Group

Founded in 1997, the Group is the largest bookmaker in Poland, and also conducts operations on an international scale. The bookmaker holds licences in Great Britain and Estonia, from where it offers its services in several markets. The Group’s service portfolio includes sports betting, betting on virtual sports, online casino (except for Poland), BetGames products and a wide range of products which involve betting on results of esports events.

The Group provides its online services not only through its website, but also through a mobile version of that website as well as dedicated Android and iOS applications and a network of approx. 400 retail betting shops located throughout Poland. The Group is constantly expanding its offer, providing, among others, more live betting services and reinforcing its leading position in esports. The bookmaker also created its own pay-out system – STSpay – which enables quick transfers 24 hours a day, 7 days a week. Additionally, the Group owns the bookmaking system created by Betsys, and makes use of that system.

Through an efficient 24-hour Customer Service system, the Group is able to meet the growing needs of its customers. On top of that, the company offers live online broadcasts of sports events via STS TV; this service is also available to mobile users. Each month, the company provides access to broadcasts of nearly 5000 sports events, including in such disciplines as football, tennis, volleyball, basketball and other sports.

The bookmaker is actively involved in supporting Polish sport, and is the largest privately owned entity in the domestic sponsorship market. The company is an official sponsor of the Poland national football team, a strategic sponsor of Lech Poznań, the main sponsor of Jagiellonia Białystok and the official bookmaker of Cracovia, Pogoń Szczecin, Górnik Łęczna, Zagłębie Lubin, the Polish Volleyball League as well as other sports clubs and associations. The Group is also involved in supporting esports.

The company has modern betting shops in every major city in Poland; in total, there are over 400 such shops located throughout Poland. The Group has over 1500 employees.

Since February 2019, the Group has been operating in European markets. Outside Poland, the bookmaker holds licences in Great Britain and Estonia, from where it offers its services in several markets. The Group is the first Polish bookmaker to begin foreign operations. In addition, the Group conducts activities in the Czech Republic (Betsys) and in Malta. The Group is also looking at the Dutch market and thinking about applying for a licence to organise gambling in the Netherlands. The Group remains focused on Poland, but expects that its international offer, including the online casino, will become a growing and important part of its activities in the future. The company also does not rule out the possibility that it may become interested in new directions of foreign expansion and that it may commercialise the Betsys system in order to offer it to other betting operators in Central and Eastern Europe in markets where the Group does not operate.

Shares of STS Holding were first listed on the Warsaw Stock Exchange on 10 December 2021. Total value of the initial public offering was approx. PLN 1.1 billion, while capitalisation of the company stemming from the final price was approx. PLN 3.6 billion. Investors purchased 46,874,998 shares, i.e. 30% of the share capital of STS Holding. Average reduction in subscriptions made by retail investors was approx. 87.2%. Mateusz Juroszek and his family continue to hold 70% of shares in the company.