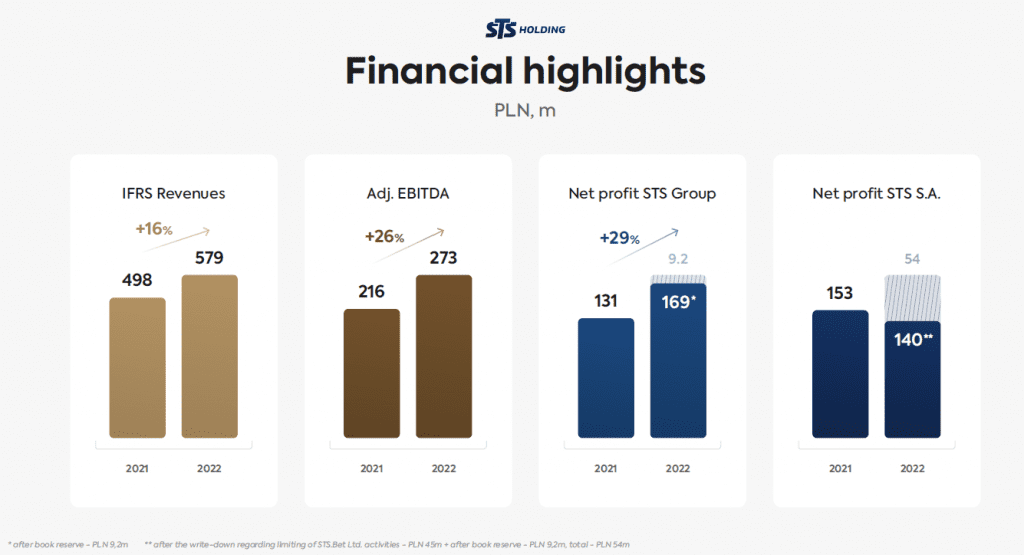

Adjusted EBITDA in the STS Group amounted PLN 273m in 2022

The STS Group reported PLN 169 million of consolidated net profit last year.

The STS Group – one of the largest bookmakers in Central Europe and the market leader in Poland – recorded consolidated revenue of PLN 579 million in 2022, compared to PLN 498 million a year earlier. This represents a year-on-year increase of over 16%. The net profit attributable to the shareholders of the parent company amounted to PLN 169 million, as compared to 131 million in 2021.[1] This represents a year-on-year increase by almost 29%. In addition, adjusted EBITDA reached the level of PLN 273 million last year, which is an increase of over 26% compared to the result from 2021. The adj. EBITDA margin in 2022 was 41.2%, compared to 38.2% the year before. Thus, it increased by 3 percentage points.

In Q4 2022 alone, the STS Group generated revenue of PLN 167 million, that is 43% more than in the previous year. Consolidated net profit attributable to shareholders of the parent company from October to December 2022 amounted to PLN 58 million, i.e. 290% more year-on-year. Adjusted EBITDA in Q4 2022 amounted to PLN 83 million, which means a year-on-year increase by 122%.

A very good year is behind us – we generated the highest operating results in the Group’s history, which translated into extremely satisfactory financial results. We will soon make a decision regarding the payment of dividends. In accordance with the applicable policy, we will pay 100% of the profit of STS Holding S.A. to the shareholders. Due to the structure of the Group, we will make two payments, as was the case last year – says Mateusz Juroszek, President of the Management Board of STS Holding.

The plan for the current year is to focus on a number of efficiencies. We focus on Poland to increase profitability and fully exploit the potential of the dynamic market. We implement savings and improve our product. We assume that turnover, NGR as well as EBITDA will be higher this year than last year – says Mateusz Juroszek, President of the Management Board of STS Holding.

In 2023, the Group is planning a number of activities aimed at increasing the profitability of its operations. To this end, the company reorganised its operations, focusing on Poland and closing its activities under licenses in the UK and Estonia. The operating results achieved by STS S.A. in 2022 indicate the extremely high attractiveness of the Polish market. The company intends to concentrate its activities in order to be able to use the development potential in the country.

In 2022, the STS Group generated NGR of PLN 663 million, compared to PLN 565 million in the previous year, which means a year-on-year increase of 17%. The value of amounts staked by the customers of the STS Group amounted to PLN 4.679 billion, compared to PLN 4.492 billion in the previous year. The number of active users amounted to 783 thousand in 2022 and 693 thousand in 2021. In 2022, the Group recorded 439 thousand new registrations (370 thousand in 2021), and the number of customers who made their first deposit amounted to 317 thousand (249 thousand in 2021). All operational data is at historical highs.

In Q4 2022 alone, the Group generated the historically highest NGR on a quarterly basis; it amounted to PLN 200 million, compared to PLN 136 million in the previous year. The value of amounts staked by the customers of the STS Group in Q4 2022 amounted to PLN 1.38 billion, compared to PLN 1.218 billion in the previous year. In Q4 2022, the number of active customers was 542 thousand, compared to 386 thousand in Q4 2021. The number of registrations in Q4 2022 was 202,000, compared to 87,000 a year earlier. The number of customers making the first deposit in Q4 2021 amounted to 154 thousand, compared to 60 thousand a year earlier.

***

More information:

STS press office

e-mail: [email protected]

***

About the STS Group

STS Group – one of the largest bookmakers in Central Europe and the market leader in Poland – was established in 1997. The portfolio of the Group includes sports betting, Virtual Sports,BetGames and a wide range of eSports.

The Group provides online services not only via the desktop website, but also through its mobile version, as well as Android and iOS dedicated applications and a network of approx. 400 retail betting shops across Poland. The Group is continuously improving its offering by, among others, providing more live bets and strengthening its leading position in the field of eSports. The bookmaker has also created its own withdrawal system – STSpay – allowing for quick transfers 24/7. The Group additionally owns Betsys – the company providing betting engine.

Thanks to effective 24/7 customer service, the Group can respond to increasing customer needs. Moreover, the company offers the opportunity to watch live sports events on the Internet, via STS TV. This service is also available to mobile users. Every month, the Company broadcasts nearly 5,000 sports events, including, among others, football, tennis, volleyball, basketball and other sports.

The bookmaker is actively involved in supporting Polish sport, being the largest private entity on the domestic sponsorship market. The Company is the official sponsor of the Polish National Football Team, the strategic sponsor of Lech Poznań, the main sponsor of Jagiellonia Białystok and the official bookmaker of Widzew Łódź, Lechia Gdańsk, Zagłębie Lubin, Polish Volleyball League and other clubs and sports associations. The Group also supports eSports.

The company has modern betting outlets, which are located in every major city in Poland – there are over 400 of them in total throughout the country. The group employs over 1,500 people.

STS Holding shares debuted on the WSE on 10 December 2021. The total value of the public offering was approx. PLN 1.1 billion, while the company’s capitalization resulting from the final price was approx. PLN 3.6 billion. The investors acquired 46,874,998 shares, or 30% of the share capital of STS Holding. The average reduction in subscriptions submitted by individual investors amounted to approx. 87.2%. Mateusz Juroszek and his family maintain 70% of the shareholding in the company.

Net of the write-down in the amount of PLN 9.2 million[1] Note 28.4 and note 38 in the Annual Consolidated Financial Statements.